Will Mortgage Rates Go Back To 3 Percent?

Will Mortgage Rates go back down to 3%? Here’s What Buyers Need to Know in 2025

During the COVID-19 pandemic, mortgage rates dipped below 3%, creating an unprecedented opportunity for homebuyers.

However, experts agree that such low rates were an anomaly, unlikely to return in the foreseeable future.

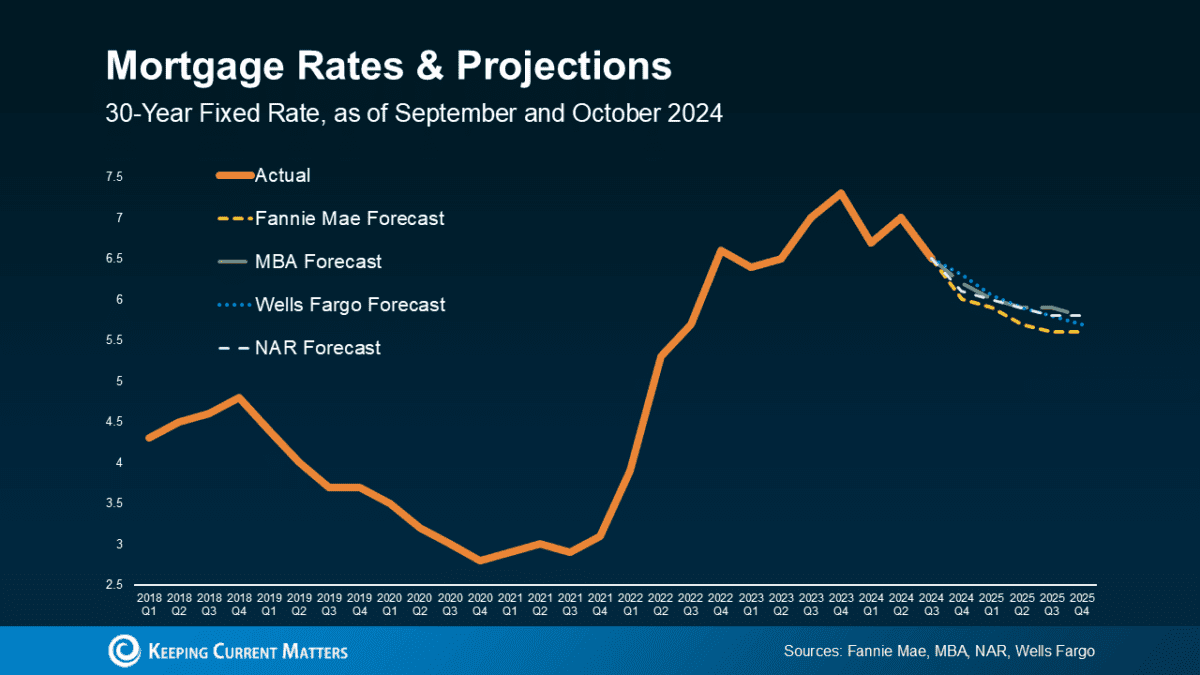

Currently, mortgage rates are hovering around 6.3% and are expected to remain in the 6-7% range through 2025.

Will Mortgage Rates Ever Return to 3%? Here’s What Buyers Need to Know in 2025

During the COVID-19 pandemic, mortgage rates dipped below 3%, creating an unprecedented opportunity for homebuyers.

However, experts agree that such low rates were an anomaly, unlikely to return in the foreseeable future. Currently, mortgage rates are hovering around 6.3% and are expected to remain in the 6-7% range through 2025.

Why 3% Rates Are Unlikely to Return

The ultra-low mortgage rates experienced during the pandemic were driven by emergency economic measures, including aggressive interest rate cuts by the Federal Reserve and large-scale bond-buying programs.

As the economy has recovered, these measures have been rolled back, leading to higher mortgage rates. Additionally, factors such as inflation, economic growth, and federal fiscal policies contribute to the current rate environment.

Current Mortgage Rate Landscape

As of early 2025, the average 30-year fixed mortgage rate stands at approximately 6.3%.

While this is higher than the pandemic lows, it is still relatively low compared to historical standards. For instance, in the early 2000s, mortgage rates were commonly above 7%.

What This Means for Buyers

While waiting for rates to drop back to 3% may not be realistic, there are still opportunities for buyers in the current market:

Increased Inventory: The number of homes for sale has risen, providing buyers with more options.

Price Adjustments: Home prices are stabilizing, and some sellers are more willing to negotiate, offering potential savings.

Long-Term Investment: Purchasing a home now can be a wise long-term investment, especially if you plan to stay in the home for several years.

Take the Next Step

If you’re considering buying a home in North Central Florida, now is a great time to explore your options.

With over 23 years of experience in the local real estate market, I can help you navigate the current landscape and find a home that fits your needs and budget.

Start your home search right on my website now.

Don’t wait for rates to drop to historic lows that may never return.

Contact me today at 352-405-1663 to discuss your home buying goals in Ocala, Dunnellon, Citrus Springs, Beverly Hills, Gainesville, and surrounding cities – and take advantage of the opportunities available in today’s market.

Ann-Marie Bortz, Realtor

Ann-Marie is a real estate agent in the Greater Ocala, Florida area with over 2 decades in the business. She is a veteran of the United States Air Force and her clients know her as a go-getter and pro-active agent specializing in the luxury market.

You May Also Like

Understanding the Real Estate Market Shift

July 22, 2024

Market Insights: Shifting Trends for Dunnellon Homes For Sale

December 10, 2024