The Pros and Cons of Purchasing Foreclosed Homes: What You Need to Know

Foreclosed homes, also known as bank-owned properties or REOs (Real Estate Owned), are properties that have been seized by the lender due to the previous owner’s inability to pay the mortgage. These homes are then sold off by the lender at a discounted price to recover their losses. Buying a foreclosed home can be a tempting option for homebuyers looking for a good deal, but it’s important to weigh the pros and cons before making a decision.

Pros of Purchasing Foreclosed Homes

One of the biggest advantages of buying a foreclosed home is the potential for significant cost savings. Since lenders are primarily interested in recovering their losses, foreclosed homes are often priced below market value. This can allow homebuyers to purchase a larger or more desirable property that may have otherwise been out of their budget. Additionally, foreclosed homes are typically sold “as-is,” meaning that any repairs or renovations needed will be the responsibility of the buyer. While this may seem like a drawback, it presents an opportunity for homebuyers who are willing to invest time and money into improving the property.

Another advantage of purchasing a foreclosed home is the potential for a quicker closing process. Unlike traditional home sales, where negotiations and contingencies can drag on for weeks or even months, buying a foreclosed home can often be a streamlined process. Since the property is already owned by the bank, there is typically less red tape involved, allowing for a faster closing. This can be particularly beneficial for homebuyers who are in a time-sensitive situation or looking to move into their new home as soon as possible.

Lastly, buying a foreclosed home can provide an opportunity for you to generate a profit. With the potential for purchasing properties at a discount, investors can either choose to flip the property for a higher price or rent it out for a steady stream of income. This can be a lucrative venture for those with experience in real estate investing and a keen eye for identifying undervalued properties.

Cons of Purchasing Foreclosed Homes

While there are several advantages to buying a foreclosed home, it’s important to consider the potential drawbacks as well. One of the main cons is the condition of the property. Since foreclosed homes are often sold “as-is,” there is a higher likelihood of you encountering issues such as neglect, damage, or even vandalism. You should be prepared to invest time and money into repairs and renovations to bring the property up to their desired standard. It’s crucial to thoroughly inspect the property and consider hiring a professional home inspector to identify any potential problems before making an offer.

Another disadvantage of purchasing a foreclosed home is the limited financing options available. Traditional mortgage lenders may be hesitant to provide financing for a foreclosed property, especially if it requires significant repairs. This can limit the pool of potential buyers and make it more challenging to secure a loan. If you are interested in purchasing a foreclosed home, you may need to explore alternative financing options such as private lenders or cash purchases.

Additionally, the purchase process for a foreclosed home can be more complex and time-consuming compared to a traditional home sale. There may be additional paperwork and legal considerations involved, and buyers may face competition from other interested parties. It’s essential to be prepared for a potentially lengthy and competitive process when buying a foreclosed home.

Factors to Consider When Buying a Foreclosed Home

Before diving into the world of foreclosed homes, there are several factors that you should consider. First and foremost, it’s crucial to determine your budget and how much you are willing to spend on repairs and renovations. While foreclosed homes may offer a lower purchase price, the cost of repairs can quickly add up. It’s essential to have a realistic budget in place to ensure you can comfortably afford the purchase and any necessary improvements.

Additionally, it’s important to thoroughly research the neighborhood and surrounding area where the foreclosed home is located. Factors such as crime rates, school districts, and proximity to amenities can greatly impact your quality of life and the future resale value of the property. Consider visiting the neighborhood at different times of the day to get a sense of the area and talk to local residents if possible.

Furthermore, you should be aware of any potential liens or outstanding debts attached to the foreclosed property. Conduct a thorough title search and work with a qualified real estate attorney to ensure there are no hidden surprises that could impact your ownership rights or future financial obligations.

Understanding the Foreclosure Process

To navigate the world of foreclosed homes successfully, it’s essential to have a basic understanding of the foreclosure process. Foreclosure occurs when a homeowner fails to make their mortgage payments, and the lender takes legal action to repossess the property. The exact foreclosure process can vary depending on the state and type of loan, but it typically involves several stages, including pre-foreclosure, auction, and bank-owned status.

During the pre-foreclosure stage, the homeowner receives a notice of default and has a specific period to catch up on their missed payments. If they are unable to do so, the property will proceed to a foreclosure auction. At the auction, the property is sold to the highest bidder, often with cash payment required. If the property does not sell at auction, it becomes bank-owned, and the lender will list it for sale on the open market.

How to Find Foreclosed Homes for Sale

Now that you have a better understanding of the foreclosure process, you may be wondering how to find foreclosed homes for sale. There are several methods you can use to locate these properties. One option is to work with a real estate agent who specializes in foreclosures. I have access to listings and can help guide you through the buying process. Another option is to search online foreclosure databases and websites that list bank-owned properties. These platforms often provide detailed information about the property, including photos and pricing.

Work with a real estate agent who specializes in foreclosures can provide several benefits. I have experience in dealing with bank-owned properties and can guide you through the buying process, from identifying suitable listings to negotiating with the lender. I can also provide valuable insights into the local market and help you make an informed decision. When choosing a real estate agent, look for someone with a track record of successfully closing foreclosed home sales and positive client testimonials.

Additionally, consider reaching out to local banks and credit unions to inquire about any foreclosed properties they may have in their inventory. Some financial institutions have dedicated departments that handle the sale of foreclosed homes and may be able to provide you with valuable insights and opportunities.

Common Misconceptions About Foreclosed Homes

There are several misconceptions surrounding foreclosed homes that can deter you. It’s important to separate fact from fiction to make an informed decision. One common misconception is that all foreclosed homes are in poor condition. While some properties may require extensive repairs, others may be in relatively good shape. It’s crucial to thoroughly inspect any potential purchase and consider the cost of repairs before making an offer.

Another misconception is that foreclosed homes are always the best deal on the market. While it’s true that foreclosed properties are often priced below market value, this is not always the case. Factors such as location, condition, and demand can impact the price of a foreclosed home. It’s important to compare the property to similar listings in the area to ensure you are getting a fair deal.

Lastly, some people believe that buying a foreclosed home is a quick way to make a profit. While it’s true that there is potential for significant cost savings, it’s not a guaranteed money-making venture. Real estate investing requires careful analysis, market knowledge, and a long-term strategy. It’s essential to approach the purchase of a foreclosed home with realistic expectations and a thorough understanding of the local real estate market.

Conclusion

Buying a foreclosed home can be an attractive option for homebuyers looking for a good deal, but it’s important to carefully consider the pros and cons before diving in. While the potential for cost savings and quicker closings can be enticing, buyers should be prepared for potential repairs, limited financing options, and a more complex purchasing process. Thorough research, due diligence, and working with professionals can help mitigate the risks and increase the chances of a successful purchase. By understanding the foreclosure process, conducting a thorough search, and setting realistic expectations, homebuyers can navigate the world of foreclosed homes with confidence.

Ann-Marie Bortz, Realtor

Ann-Marie is a real estate agent in the Greater Ocala, Florida area with over 2 decades in the business. She is a veteran of the United States Air Force and her clients know her as a go-getter and pro-active agent specializing in the luxury market.

You May Also Like

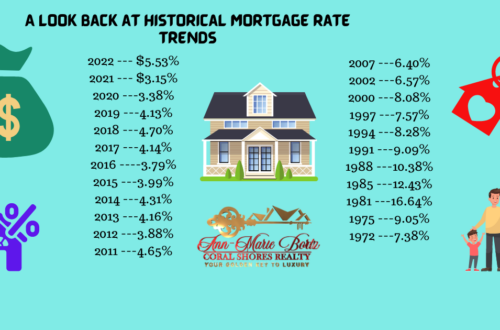

What would happen if Housing Interest Rates Hit 8%

August 22, 2023tips on how to get your listings online

October 11, 2015