2023 Tips to Selling For Sale By Owner

Selling your home as a For Sale by Owner (FSBO) can be a great way to save money on real estate commission fees and have more control over the process. However, it is important to understand both the benefits and drawbacks that come with this type of sale before you decide to go the FSBO route. In this guide, we will explore all the necessary steps to successfully sell your home as a For Sale by Owner. Introduction to Selling Your Home as a For Sale by Owner Selling your home as a For Sale by Owner (FSBO) can be a great way to save money on real estate commission…

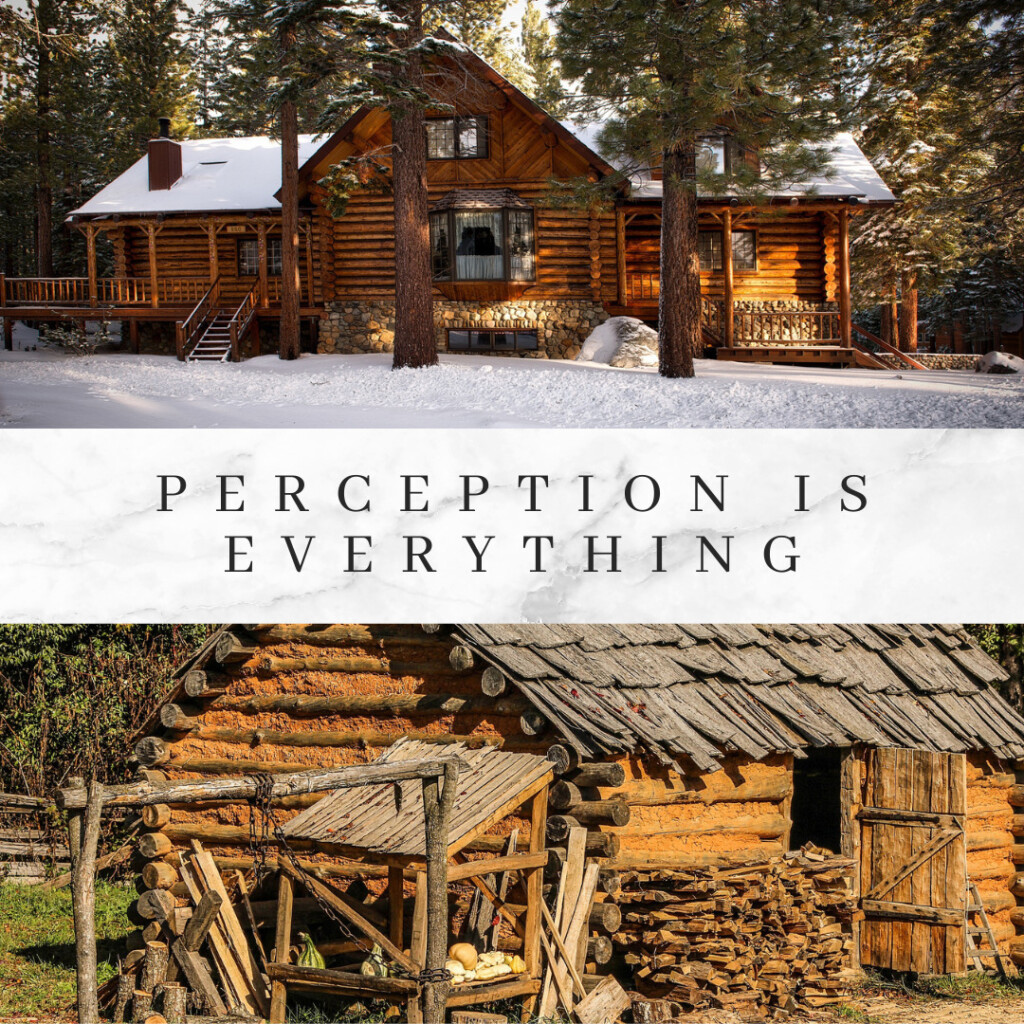

Why Quality Real Estate Photos Matter When Selling Your Home.

Human beings are visual creatures, so photos real estate photos are the first thing that grab our attentions when we are looking at a listing. But, as anyone who has ever hired a real estate agent can attest, not all agents take professional photography. Its still quite common here in the greater Ocala area, to see agents using their cell phones to take pictures to use as the real estate photos on the MLS and in their marketing of a property they listed. Let’s take a look at why I believe professional photos are necessary if you want to shorten the time your home sits on the market and attract…

How to Sell Your Home in a Recession or Slow Economy

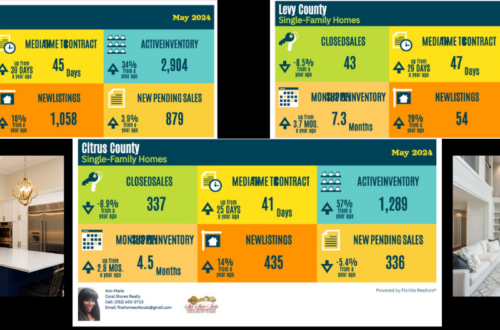

They say “timing is everything”, but none of us has a crystal ball. So if you missed the buying frenzy of the last 2 years, you will need a good strategy to have success in selling your home today. Many economist agree that we are likely to face a recession in the near future and with rapidly rising interest rates, this combination has affected home sales no matter where you live in the country. For the first time in 2 years, we are seeing homes listed for sale with list price reductions as well as an ever increasing inventory. From the graph in green below, showing homes priced between $300-$500K, with…

Hurricane Ian – What To Do After The Storm

Hurricane Ian just devastated most of Southeast Florida! Now what? If you were affected by this storm, or know someone who was, time is of the essence to get things done. I have lived in Florida since 1980, and I can tell you that when you survive a Category 1 or 2 with minimal damage you become jaded and don’t take the warnings as seriously until something like Hurricane Ian comes though! I lived in S. Florida during hurricane Andrew, Wilma and many others, so I have seen firsthand what this category of storm can do! Unfortunately, not everyone in the state has been though a category 4 or 5…

How To Sell Your Home In A Buyers Market

The real estate market frenzy is over, so how do you sell your home in a buyer’s market? First let’s look at what was happening in the market over the past 2 years. The inventory was at an all time low, with more buyers than properties for sale, that put sellers squarely in the driver’s seat of the real estate market. Sellers could list a property and within 24 to 48 hours they had multiple offers with many over asking / list price and some buyers giving up the right to inspections. But as the old saying goes, “all good things must come to an end”; in this case for…

What The 2022 Real Estate Market Changes Mean To You

Unless you have been hiding under a rock, you know the real estate market is changing! Everyone has heard the debate about whether we are or we are not in a recession. But if you own a home, there are several factors at play that will change the way you have to market your home in the coming months. In real estate there are 3 types of markets. There is a sellers market, which we have been in since the beginning of the pandemic, a buyers market which we had for years following the real estate market crash in 2008, and a balanced market which favors neither sellers nor buyers.…

Fine Homes Of Ocala

Your Golden Key To Luxury